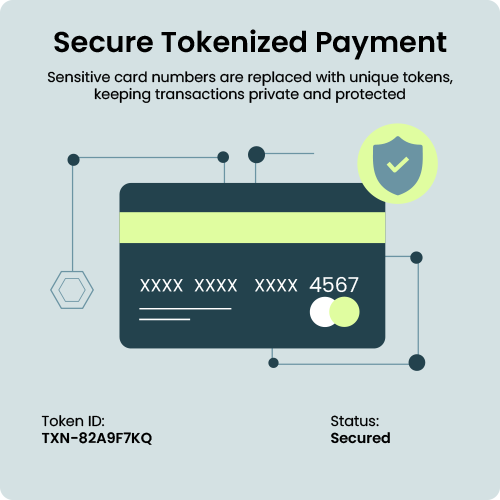

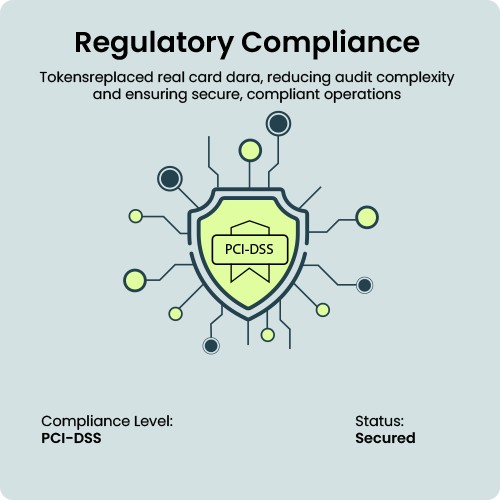

Tokenization ensures that sensitive card numbers are never exposed during transactions. Instead, unique tokens replace real details, reducing the risk of fraud. By hiding actual card credentials, customers gain peace of mind, and merchants maintain safer payment flows.